Distress and Opportunities in the Renewables Market

Thoughts from Fox Rothschild, Gordian Group & XIP

Originally published by the Carolinas Clean Energy Business Association

December 15, 2025

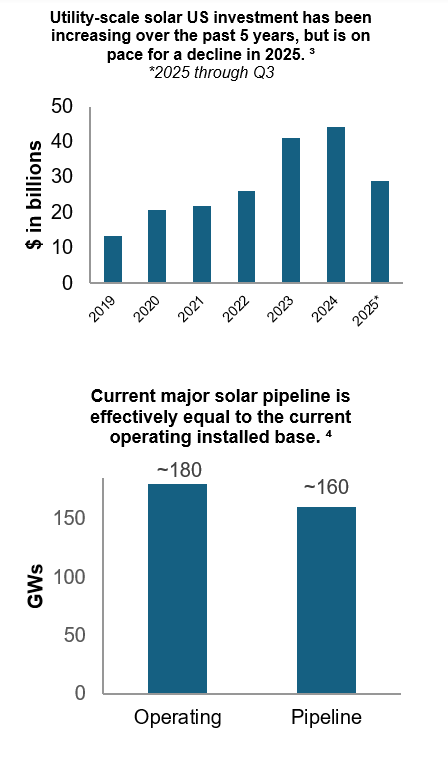

In recent years, renewable energy projects, particularly solar, attracted an incredibly large amount of investment dollars from credit providers, pension, infrastructure, and private equity funds. Renewable projects drew attention due to their perceived low risk, stable returns, and ESG orientation, all supported by a favorable tax credit regulatory environment. In 2024 alone, investors funneled a historic $807 billion worth of capital globally into renewable energy[1]. In the United States, the solar development pipeline stands at 175 GW and is equal to the current installed operating solar base[2].

But industry momentum has slowed in 2025 and storm clouds loom. Rising costs exacerbated by supply chain constraints, regulatory uncertainty, and tightening financial conditions are turning a once thriving sector into one riddled with uncertainty and challenges. The bankruptcy filings of Posigen, PBC, et al ($700 million of invested capital) and Pine Gate Renewables ($12 billion of invested capital) may represent the first events of a larger industry reckoning, or at least a near-term retrenchment, as developers reassess their pipelines and portfolios and lenders across the capital stack more closely track their investments at the effect of the expiration of the solar tax credits. However, there remain bright spots in the industry that well-capitalized buyers can use to their advantage.

Below we discuss what has changed in the renewables market in recent years and then address strategies developers should take to identify and tackle stress. We end with a discussion about how to pursue M&A opportunities in a stressed environment. Importantly, given the complexities of renewable capital structures, which restructurings and workouts only magnify, developers must work with strong advisors as they attempt to navigate the current reality.

How is the renewable market changing?

Global headwinds are altering project economics unfavorably. Costs are rising on both the operating and financing side. Interest rates remain stubbornly high, and labor and input costs continue to rise. This combination is driving larger upfront capital requirements to fund projects and, therefore, tightening margins. Especially in the United States, tariffs add to this pressure. Beyond input price inflation, supply chain disruptions create further risks as delays in project timelines push out project profitability by months if not years (amplifying the effects of Devco SG&A burn) and reduced availability of suppliers erodes buyers’ negotiation power.

Policy shifts reduce access to capital. For years, tax credits have supported the market, but recent federal and state-level adjustments have eroded the facility through the following key changes:

- The OBBA restricts eligibility for tax credits, and projects must either (i) begin construction by July 4, 2026, and enter service within four calendar years or (ii) enter service by Dec. 31, 2027.

- Due to FEOC restrictions, projects that begin construction after 2025 become ineligible for ITCs and PTCs if they receive material assistance from a prohibited foreign entity.

- Treasury Guidance (Notice 2025-423) eliminates the 5% safe harbor test going forward for most projects and leaves only the physical work test in place. The test requires evidence of physical work of a significant nature, which developers can satisfy by procuring major components (e.g., Main Power Transformers).

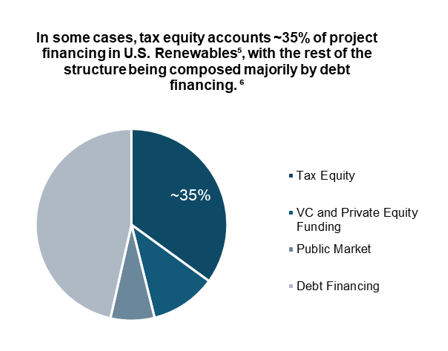

The phase out of tax credits will significantly impact the capital structures of renewable energy developers and their projects. Tax equity is a critical piece of development financing, in some cases, accounting for 35%[5] or more of a project’s capital needs. With the removal of the ITC, other options must carry the burden, whether through increased sponsor equity, greater amounts of debt financing, increases in PPA/off-take pricing, or cost-cutting exercises.

Tightening capital leads to distress. Due to the aforementioned, liquidity in the market is tight and investors are more selective in deploying capital, favoring projects with reduced risk and clear-cut economics. This shift leaves developers exposed, particularly those with large development pipelines and limited construction/operating assets. Projects underwritten in a low-rate environment now confront both the increased development costs discussed above and increased return requirements from investors.

What should developers do?

With uncertainty in the future, hope cannot be a strategy. Especially where project developers are bidding into competitive procurements, there is significant pressure to make aggressive assumptions about future market conditions. But betting on positive movements in interest rates, policy changes or market demand will leave developers exposed. Importantly, acting sooner rather than later is essential as more options are available to developers who get ahead of the curve. Engaging with lenders/investors while still in compliance with covenants and debt agreements also provides leverage. If companies wait until they go over the cliff (i.e., an imminent liquidity crisis or covenant default), they will meaningfully reduce their leverage in negotiations and put themselves at the mercy of their creditors. But if you recognize potential problems well ahead of time, you and your advisors can go to your lenders with a portfolio of credible options.

Ensure your projections reflect the new reality. Management teams and their advisors must establish realistic views of projections and cash flows, despite pressure to do the opposite. Without reliable and defensible projections, developers can’t make informed capital allocation decisions. Stakeholders will identify overly optimistic projections as part of their diligence, which will not only erode trust between parties but also force you to spend more time debating model assumptions instead of focusing on how to fix the capitalization problem.

Off-takers and EPC/suppliers also need to be brought into the fold if projects are underwater in today’s market. Developers and their advisors need to engage with these parties to make it clear that absent changes to the deal, the project will shut down. In traditionally regulated markets where regulated utilities are effectively the only offtakers, industry players must continue to educate utilities and regulators to ensure that policy aligns with market realities. Securing concessions from operating stakeholders will likely improve your ability to secure concessions from financial ones.

Be proactive with suppliers before issues escalate. Supply chains are already disrupted. To avoid the trickle-down effects from overdependency, developers need to stay a step ahead. Understanding the stability of vendors from both a capitalization and operational perspective is essential. Developers need to maintain constant visibility into suppliers’ health through heightened communication and auditing workflows. Additionally, developers must diversify their supply chains. Historically, the industry relied heavily on Asian mining and manufacturing, which exposes developers to disruptions and weakens bargaining power. Building a more diverse, sustainable network limits both vendor and geopolitical risks.

Be aggressive on costs now. Management teams need to be vicious on costs. To obtain concessions from lenders (new capital, amendments, etc.), companies must show stakeholders they are willing to share in the pain. Capital providers will be more likely to provide new money or amend terms of current contracts if developers show they recognize the situation and are taking steps to address it.

Another area where this focus can be seen is in pivoting SG&A budgets to an M&A focus. Many developers built a large overhead burden when capital was readily available. Well-capitalized companies can repurpose development SG&A into acquiring attractive development assets, turning a cost center into a value creator that will appeal to stakeholders. With all the disruption in the market, properly positioned companies with a long-term investment horizon can redirect SG&A dollars to pursue strategic acquisitions.

Have a realistic view of your pipeline. Despite investor enthusiasm through 2024 when businesses were raising money off projects five to ten years down the line, development pipelines today should be regarded as liabilities, not assets. Projects may have been underwritten in a 10–12% return environment in 2024, but the current market for returns is meaningfully higher for development assets. Recognizing this allows developers to adjust their strategy to maximize value. Developers can capture short-term value by completing projects quickly (where feasible), capitalizing on available safe harbors, or divesting assets with valuable attributes (e.g., a PPA or Interconnection Agreement). Long-term value is harder to gauge due to the uncertainty in the market, but developers and their advisors need to recognize which of these projects are worth saving and preserve them for a more opportune day while finding ways to exit the others.

When recognizing the assets’ worth, management still needs to strike a careful balance between divesting assets and giving away the best collateral. Too often companies monetize operating assets to pay for high-risk development projects. Companies often focus on the idea of living to fight another day without evaluating what that future actually looks like. Advisors can play a meaningful role here.

Understand your capitalization and underlying documents. Development company capitalizations are more complex than ever, combining traditional construction loans, permanent debt and tax-equity financing with back leverage, cross collateralizations, devco lending and other new instruments. Complemented by letters of credit and power purchase and interconnection agreements among other key contracts, these structures interact in intricate ways, especially in distressed situations. Working closely with advisors to map them will play a vital role in evaluating leverage points.

Identify the “biggest loser”. Given the stakeholder complexities involved in renewable development, there will be clear winners and losers. Advisers can help companies identify the economic outcomes for all parties involved with a focus on those whose outcome will be the most severe. The most at-risk parties (i.e., the biggest losers) can then be leveraged to the benefit of the developer and their sponsor because they will be most willing to make concessions instead of recognizing a meaningful loss.

Develop carrots and sticks. One of our mantras is to prepare for war in the hope that peace breaks out. After a complete overview of the company and its prospects, developers can work with their advisors to develop a suite of options to consider and precure on. To obtain favorable concessions from stakeholders, these options cannot be limited to consensual value-maximizing proposals. Companies need to present their stakeholders with their targeted desired outcomes alongside less desirable alternatives that they will deploy if stakeholders do not cooperate. These strategies (the sticks), while likely not desirable for developers and their sponsors, will look even less attractive to lenders and creditors and push them towards a consensual plan that maintains value for junior constituencies. Advisors play a paramount role in developing these stick strategies because they must be credible and actionable for counterparties to take them seriously.

How do developers / investors play offense?

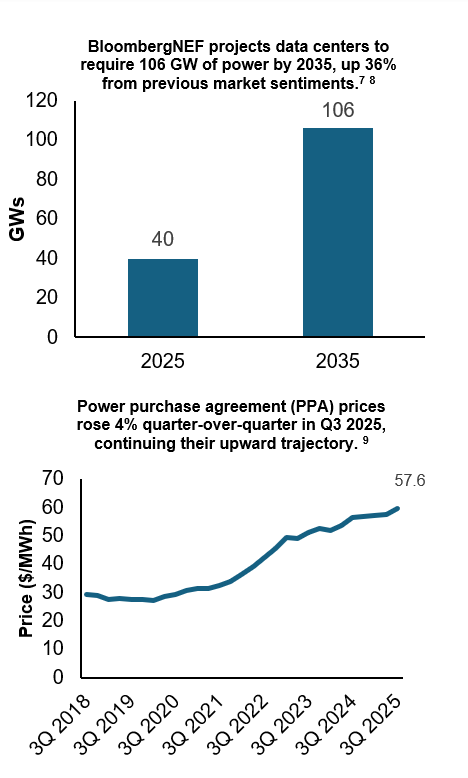

In a distressed market, not all is bleak. Optimism still surrounds the market, driven by surging demand for power by data center development[7][8] and rising PPA prices[9]. There is opportunity for lucrative returns and well-capitalized players are in prime position to utilize others’ struggles to their advantage. However, the renewables industry is complex, with numerous stakeholders holding claims and security interests across multiple asset bases. To unlock value through a distressed acquisition, buyers need to obtain the assets free and clear of potential claims, which creates a strong need for experienced advisors.

Distressed acquisitions  generally follow two paths: (i) bankruptcy and (ii) out-of-court. A bankruptcy transaction is more straightforward because the court provides a venue to purchase assets free of all liens, but bankruptcy is often expensive and not an option for many midsized companies. An out-of-court transaction, by contrast, requires more intricate structuring to protect the buyer from claims. With preparation, extensive diligence and the support of trusted, expert advisors, investors can turn a struggling industry into a source of lucrative returns.

generally follow two paths: (i) bankruptcy and (ii) out-of-court. A bankruptcy transaction is more straightforward because the court provides a venue to purchase assets free of all liens, but bankruptcy is often expensive and not an option for many midsized companies. An out-of-court transaction, by contrast, requires more intricate structuring to protect the buyer from claims. With preparation, extensive diligence and the support of trusted, expert advisors, investors can turn a struggling industry into a source of lucrative returns.

Identifying the “diamonds in the rough”. Among struggling developers, assets with upside remain. Well-positioned players can cherry-pick these assets and consolidate them into their own portfolios to capitalize on discounted and overlooked opportunities. Many discounted assets will become available as stakeholders, unable to maintain them, accept minimal returns (either as cash or junior equity/warrants) to offload the burden of financing them through completion. These assets can provide meaningful value to a buyer through long-term PPAs, land leases or interconnection positions that a stressed market participant cannot realize due to undercapitalization and/or liquidity constraints. Adding these assets into a strong portfolio with an experienced development team can elevate overall performance. Nevertheless, extensive diligence is essential when identifying the diamonds in the rough to ensure that contracts are transferable and enforceable and that legacy liabilities of the seller do not attach to the acquired assets.

Taking over projects of financially distressed developers. Lenders are not structured to operate projects, so when they are forced to step in, developers encounter a significant opportunity. This partnership can benefit both parties by rescuing and advancing the value of projects that currently underperform. In the Pine Gate bankruptcy, for example, Fundamental Renewables as lender, is acquiring a portfolio of 128 solar projects in development (plus three in construction/operations) against roughly $900 million invested in Pine Gate. Portfolios like this offer acquisitive developers a chance to acquire assets at advantageous prices while concurrently allowing lenders to mitigate their risk.

Fixing struggling projects. Throughout the industry, some players face bottlenecks. Whether EPC underperformance, module procurement failures, zoning and regulatory challenges, or interconnection issues created the problem, well-positioned developers can offer support and capital. By deploying their expertise and capabilities, these developers can alleviate operational difficulties and elevate the projects. Structures including preferred investments with fixed returns and a sharing of upside with current owners can appeal to parties that worry about funding their commitments but also want to benefit from their sweat equity.

Conclusion

A turbulent 2025 is transforming renewables from a momentum story into a stress test of capital structures, risk management, and execution discipline, but it has not diminished the sector’s long-term opportunity. Developers that confront reality early—by resetting projections, engaging stakeholders, rationalizing pipelines, and attacking costs—can stabilize their platforms and preserve option value for a recovery. At the same time, well-capitalized investors who understand the legal, financing, and operational nuances of distressed situations can use restructurings, targeted acquisitions, and project turnarounds to assemble high-quality portfolios at attractive entry points, positioning themselves to capture the next wave of growth as policy, power markets, and capital markets ultimately reset.

Works Cited

[1] International Renewable Energy Agency & Climate Policy Initiative. (2025, November). Global landscape of energy transition finance 2025. Abu Dhabi: IRENA. ISBN 978-92-9260-692-3.

[2] American Clean Power Association. (2025). Snapshot of clean power in 2024. Washington, D.C.: American Clean Power Association. PDF.

[3] Clean Investment Monitor. (2025). “Clean Investment Monitor.” Rhodium Group & MIT CEEPR. https://www.cleaninvestmentmonitor.org/

[4] Solar Energy Industries Association (SEIA). Major Solar Projects List. Available at: https://seia.org/research-resources/major-solar-projects-list/.

[5] Renewables Valuation Institute. Tax equity in U.S. renewables: ITC, PTC & structures. https://courses.renewablesvaluationinstitute.com/pages/academy/tax-equity-in-us-renewables-itc-ptc-structures

[6] Mercom Capital Group. (2023). Annual and Q4 2023 Solar Funding and M&A Report. Mercom Capital Group. https://mercomcapital.com/product/annual-q4-2023-solar-funding-ma-report/

[7] Saul, J. (2025, December 1). What AI bubble? BNEF outlook for data center power use rises 36%. Bloomberg. https://www.bloomberg.com/news/articles/2025-12-01/what-ai-bubble-bnef-outlook-for-data-center-power-use-rises-36

[8] Yahoo Finance. ‘Hotspots are getting hotter’ in US data-center boom. https://finance.yahoo.com/news/hotspots-getting-hotter-us-data-124239545.html

[9] LevelTen Energy. (2025, October 14). North America PPA Price Index, Q3 2025.

About the Authors

Rob Sternthal is a Managing Partner at XIP who has led over $25 billion in renewable power and energy infrastructure transactions across two decades, building multiple market-leading platforms from the ground up—including CohnReznick’s Capital Markets group, which he scaled to nearly $20 billion in deal volume with a 30-person team.

Peter S. Kaufman is President and Head of Restructuring and Distressed M&A at Gordian Group. He is co-author of Distressed Investment Banking: To the Abyss and Back – 2nd Edition and Equity Holders Under Siege: Strategies and Tactics for Distressed Businesses, frequently speaks on restructuring and bankruptcy topics, and serves as an adjunct faculty/lecturer at the University of Virginia School of Law. Peter graduated from Yale College and the University of Virginia School of Law.

Liam D. Ahearn is a Partner at Gordian Group and has lead several successful advisory and investment banking engagements during his time at the firm across a range of industries. Prior to joining Gordian, he held a senior position at Capstone Advisory Group and at Lehman Brothers before that. Liam completed the CIRA program.

Brett A. Axelrod, Managing Partner of Fox Rothschild’s Las Vegas office and former Co-Chair of the nationwide Financial Restructuring & Bankruptcy Department, focuses on business reorganization, bankruptcy, asset sales and acquisitions, and gaming.

Benjamin L. Snowden, a Partner at Fox Rothschild, is an accomplished clean energy and environmental lawyer who represents independent generators and large energy customers in permitting, compliance, and transactional matters. He also advises on environmental permitting, compliance, and enforcement matters.

Whether it be with regard to engaging an advisor, looking for a capital partner, or seeking out a thought partner as you contemplate the evolution of private investment in critical infrastructure, we would welcome the opportunity to connect with you.

Securities Products and Investment Banking Services are offered through BA Securities, LLC. Member FINRA SIPC. Expedition Infrastructure Partners, LLC and BA Securities, LLC are separate, unaffiliated entities. To learn more about the professional background of Expedition Infrastructure Partners, LLC and our Registered Representatives, please visit FINRA BrokerCheck. Past performance, awards, or testimonials are not indicative of future results. No guarantee of future performance or success is implied.

© 2026 Expedition Infrastructure Partners, LLC. All Rights Reserved.